Bitcoin Halving Countdown 2028: Understand What Bitcoin Halving Means

Bitcoin halving stands among the most anticipated moments in the cryptocurrency world. It is a built-in event that defines Bitcoin’s scarcity, influences price behavior, and reshapes miner economics. Each countdown leading to this event captures attention from traders, long-term investors, and enthusiasts alike. The Bitcoin halving countdown represents more than a timer — it reflects the heartbeat of Bitcoin’s economic design. Understanding what it means, why it happens, and how it shapes the market helps every participant navigate this ever-evolving ecosystem.

What Is Bitcoin Halving?

Core Concept

Bitcoin halving refers to a programmed reduction in the block reward miners receive for validating transactions on the network. The Bitcoin protocol dictates that every 210,000 blocks, the reward is cut in half. This process continues until the total supply reaches 21 million coins.

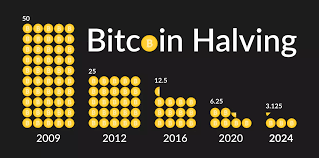

When Bitcoin began in 2009, miners earned 50 BTC per block. The first halving reduced it to 25 BTC, the second to 12.5 BTC, the third to 6.25 BTC, and the fourth in 2024 brought it down to 3.125 BTC. The next halving will reduce that again to 1.5625 BTC.

This automatic adjustment maintains scarcity, slows the rate of new issuance, and reinforces Bitcoin’s role as a deflationary digital asset.

Read Also: Luna Classic: Live LUNC Price, News & Market Insights

Why Halving Exists

Bitcoin’s creator designed the halving mechanism to prevent uncontrolled inflation. Traditional currencies can be printed without limit, but Bitcoin’s supply is capped. By reducing issuance periodically, the system ensures that each coin becomes harder to obtain over time.

Halving also serves as an incentive reset for miners, pushing them toward more efficient operations. As rewards shrink, only those capable of optimizing their costs continue to thrive. This balance preserves both network security and economic sustainability.

How the Countdown Works

Block Height Versus Calendar Date

A common misconception about the halving countdown is that it’s based on a specific date. In truth, the halving occurs when the blockchain reaches a particular block height — every 210,000 blocks mined since the previous halving. Because each block takes roughly ten minutes to produce, the date can vary by days or even weeks.

Estimating the Next Halving

Analysts and trackers use the average block time to estimate the next halving. Since block times fluctuate slightly depending on network activity and hash rate, countdown timers update frequently. The next halving is projected to occur around early to mid-2028.

These countdowns provide a sense of anticipation, creating a rhythm for market participants who prepare portfolios, adjust mining strategies, and follow sentiment shifts as the event draws near.

Why the Countdown Shifts

The Bitcoin network automatically adjusts mining difficulty every two weeks to maintain a steady block production rate. When hash power increases, blocks are found faster, and when it decreases, block times lengthen. Because of this dynamic system, countdown estimates continually shift. That’s why even the most accurate trackers cannot pinpoint the exact day until the final weeks before halving.

Why the Bitcoin Halving Countdown Matters

Investor Psychology

The countdown builds psychological energy. Every halving cycle reignites discussion, speculation, and optimism. Investors view the approaching event as a milestone — a reminder of Bitcoin’s scarcity and predictable monetary policy. As the timer ticks closer, media coverage increases, trading volumes surge, and narratives strengthen.

Supply Shock and Price Behavior

Halving reduces the rate at which new coins enter circulation. With fewer coins created, supply growth slows dramatically. If demand remains stable or rises, basic economics suggests upward pressure on price. Historically, major bull runs have followed previous halvings, although each cycle differs in magnitude and timing.

The countdown captures the moment when supply pressure tightens. However, markets often anticipate this effect months in advance, meaning price action can occur before or after the actual event.

Impact on Miners

Miners form the backbone of Bitcoin’s security network. When halving cuts their rewards, revenue per block declines. Smaller or inefficient miners may find operations unprofitable and shut down, while larger, well-capitalized miners consolidate. This shift can temporarily reduce the total hash rate until the network adjusts difficulty downward.

Over time, a stable equilibrium returns. The halving thus acts as both a test and a filter for mining efficiency.

Lessons from Previous Halvings

Bitcoin has already undergone multiple halvings, and each has marked a new chapter in its history.

The first halving in 2012 dropped rewards from 50 to 25 BTC. Shortly after, Bitcoin’s price began a long-term climb. The second halving in 2016 cut rewards to 12.5 BTC, leading into the massive rally of 2017. The third halving in 2020 lowered rewards to 6.25 BTC, setting the stage for the 2021 bull run that saw Bitcoin reach record highs. The 2024 halving, reducing rewards to 3.125 BTC, has introduced a new cycle that continues to unfold.

Each halving reinforces Bitcoin’s scarcity narrative and attracts renewed attention from both retail and institutional investors. However, outcomes vary because external factors — macroeconomic trends, regulation, and global liquidity — influence each cycle differently.

How to Prepare as the Countdown Progresses

Follow Reliable Data Sources

Tracking real-time block data from reputable explorers ensures accurate countdown information. Live updates reflect changes in network speed, hash rate, and estimated halving date. Staying informed prevents acting on outdated figures or speculative assumptions.

Monitor Market Sentiment

As the countdown approaches, watch trading behavior and on-chain data. Exchange inflows, whale accumulation, and overall sentiment shifts often precede significant price movements. Understanding how larger participants position themselves provides valuable clues about market expectations.

Manage Exposure and Risk

While halving creates excitement, volatility often spikes before and after the event. Managing risk, setting realistic targets, and maintaining a balanced portfolio prevents overexposure to sudden market swings. Smart investors treat halving as part of a long-term narrative, not a one-day trigger for profits.

Keep Perspective

Halving highlights Bitcoin’s fundamental design but doesn’t guarantee immediate results. Price reactions can be delayed or muted depending on demand, liquidity, and global market sentiment. The countdown should serve as a guidepost for strategy, not a promise of profit.

Risks and Misconceptions

Many assume halving automatically drives prices upward, but history shows variation. While supply reduction creates upward potential, demand must match it. Relying solely on historical performance can lead to unrealistic expectations.

Another misconception is that halving determines the exact turning point of a bull cycle. In reality, market cycles overlap. Halving influences the foundation, but external elements such as monetary policy, regulation, and global adoption trends shape outcomes.

From the mining perspective, revenue cuts can create temporary network instability. Smaller miners may exit, lowering hash rate until difficulty readjusts. Over time, however, equilibrium returns as efficiency improves.

The countdown itself can also mislead newcomers who see it as a fixed date. Because network conditions fluctuate, countdowns serve as estimates — not guarantees.

What to Expect as the Countdown Nears

As the halving countdown enters its final months, expect growing excitement. Social media buzz increases, news outlets amplify coverage, and analysts publish forecasts. Exchanges and trading platforms often see rising activity as investors reposition portfolios.

Price volatility tends to rise as well. Some traders “buy the rumor, sell the news,” meaning markets can experience sharp corrections before or after the event. Patience, discipline, and data-driven strategies become essential.

Once halving occurs, markets often go through an adjustment period. Supply drops instantly, but price responses can take months. Historically, major rallies have followed after consolidation phases rather than immediately after the event.

Conclusion

The Bitcoin halving countdown symbolizes much more than a ticking clock. It embodies the principles that make Bitcoin unique — transparency, scarcity, and decentralization. Every tick toward the next halving reinforces trust in Bitcoin’s predictable monetary schedule, a stark contrast to inflationary fiat systems.

Understanding what the countdown represents allows participants to approach it with clarity rather than emotion. It invites miners to innovate, investors to strategize, and the community to reflect on Bitcoin’s progress.

As the next halving approaches, the countdown continues to serve as a reminder of Bitcoin’s ingenious design. Whether one trades, mines, or simply watches, the anticipation surrounding the halving reflects the shared belief in a future built on limited supply, digital sovereignty, and enduring value.

FAQs

What is the Bitcoin halving countdown?

The Bitcoin halving countdown tracks time until the next block reward reduction, signaling a key milestone in Bitcoin’s supply cycle.

When is the next Bitcoin halving expected?

The next Bitcoin halving is estimated to occur around April 2028, depending on block production speed.

Why does Bitcoin halving matter?

Halving reduces new Bitcoin supply, often influencing price, mining profitability, and overall market sentiment.

How often does Bitcoin halving occur?

A Bitcoin halving happens every 210,000 blocks, roughly every four years, as programmed in the Bitcoin network code.

Does halving always increase Bitcoin’s price?

Not always. While past halvings led to price rises, results vary based on demand, macro conditions, and investor sentiment.

Post Comment